Use & Setup QuickBooks Fixed Asset Manager in Desktop

Table of Contents

- 1 Use & Setup QuickBooks Fixed Asset Manager in Desktop

- 1.1 How to Set up QuickBooks Fixed Asset Manager (FAM)?

- 1.1.1 Income Tax Form

- 1.1.2 Setting General Ledger Account in QuickBooks Fixed Asset Manager

- 1.1.3 Fixed Asset Manager Client Wizard

- 1.1.4

- 1.1.5 Adding Asset in Fixed Asset Manager

- 1.1.6 Asset Synchronization

- 1.1.7 How to Use QuickBooks Fixed Asset Manager

- 1.1.8 Assigning Account to Multiple Assets

- 1.1.9 Changing or Adding Depreciation Methods

- 1.1.10 Depreciating an Old Asset

- 1.1.11 Exporting QuickBooks Fixed Asset Items into ProSeries Form 4562

- 1.1.12 Importing Fixed Assets from Excel into Fixed Asset Manager

- 1.1.13 Selecting the Basis on Posting the Journal Entries

- 1.1 How to Set up QuickBooks Fixed Asset Manager (FAM)?

QuickBooks financial accounting software is one of the building blocks for both small and medium scale businesses. The accounting software offers various accounting features to manage and track all the financial transactions of the company. One of the most used features of the software is the QuickBooks Fixed Asset Manager (FAM). Every fixed asset that is incurred by any business depreciates over a substantial period.

QuickBooks Fixed Asset Manager (FAM) allows you to track fixed assets and use multiple depreciation methods. The feature uses depreciation methods as per the standards published by the IRS.

Since there are different types of data files in QuickBooks desktop and Fixed Asset Manager, it is essential to set up and manage QuickBooks Fixed Asset Manager for correct financial data related to fixed assets and depreciation.

How to Set up QuickBooks Fixed Asset Manager (FAM)?

Charging depreciation on fixed assets is one of the most important features of Fixed Asset Manager. The depreciation process helps the business owners to calculate the real value of a fixed asset.

Hence it becomes important to set up QuickBooks Fixed Asset Manager for correct financial data. Five different steps involved in setting up Fixed Asset Manager are

Income Tax Form

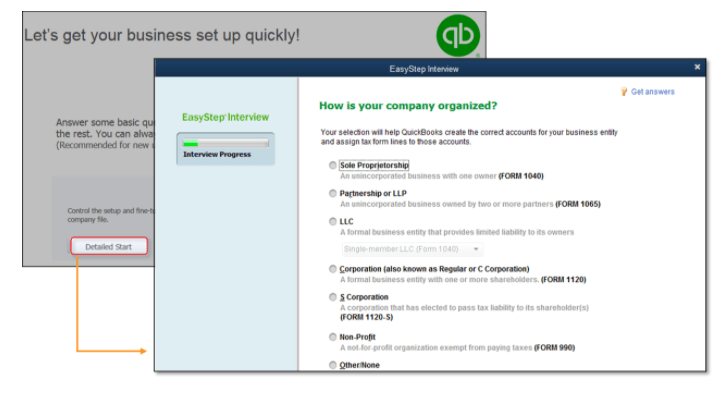

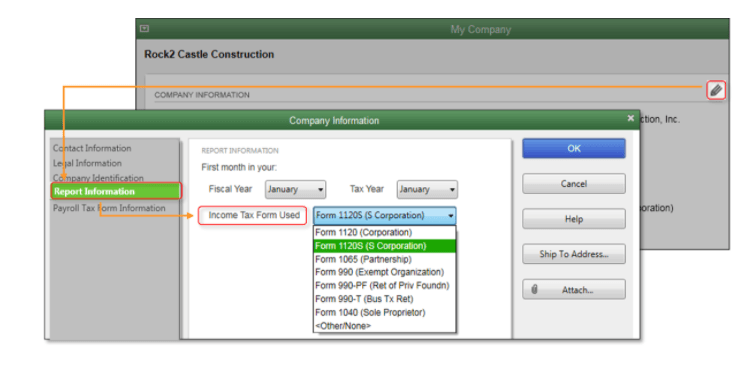

The first step that is done while setting up Fixed Asset Manager is the income tax form. The form helps the business owners to track depreciation on fixed assets as per the appropriate tax line.

If you have a QuickBooks desktop data file, you can set up the income tax form in report information, which is present under my company information.

Setting General Ledger Account in QuickBooks Fixed Asset Manager

The second step that is followed after setting up an income tax form is the general ledger account. All the financial transactions are recorded in the books of accounts for accurate data information.

QuickBooks Fixed Asset Manager desktop uses nominal account setup wherein individual accounts set up is done per fixed asset. The minimal account set up of Fixed Asset Manager includes three accounts dubbed as fixed asset account, accumulated depreciation account, and depreciation account.

Fixed Asset Manager Client Wizard

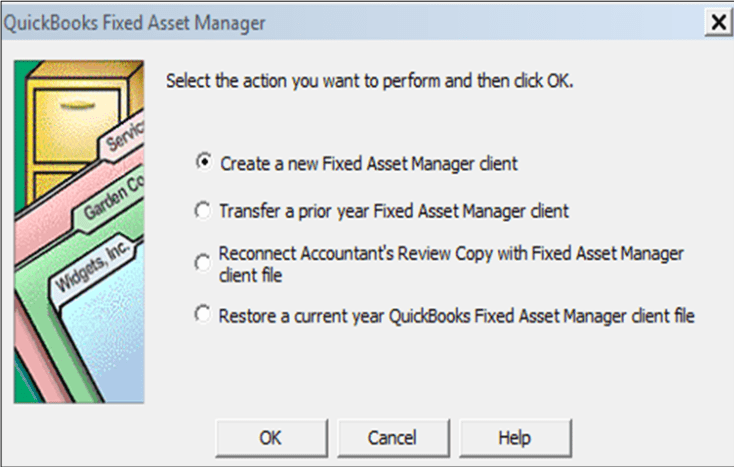

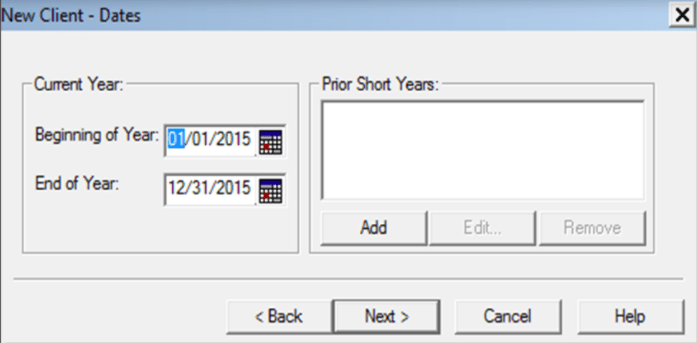

The next step in setting up Fixed Asset Manager is the FAM client wizard.

You can open the Fixed Asset Manager account from the manage fixed asset account option located under the accountant menu.

There are multiple options, such as the creation of a new Fixed Asset Manager client, transfer of prior year Fixed Asset Manager client, and many more.

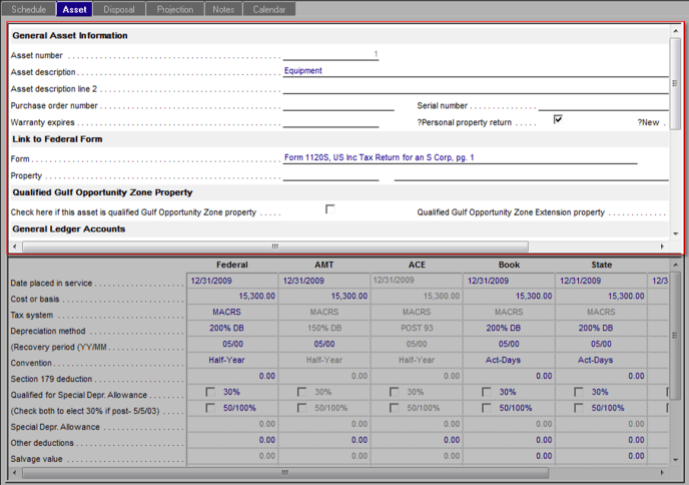

Adding Asset in Fixed Asset Manager

If you have already set up fixed assets account on the QuickBooks desktop, you will not have to follow these steps.

However, if you have not set up a fixed assets account, you can insert assets from the add asset button under the toolbar option.

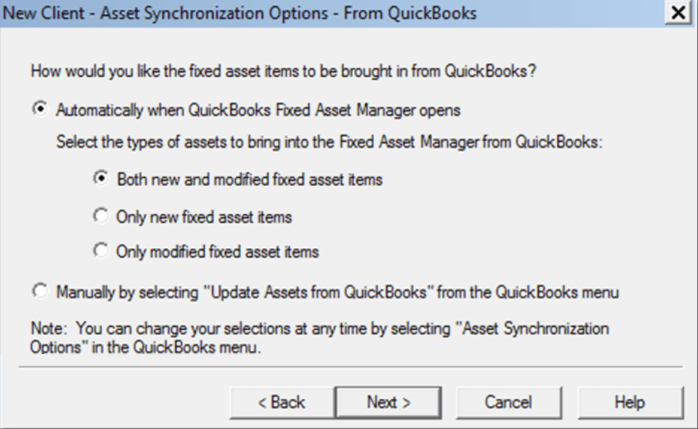

Asset Synchronization

The business owner needs to sync the financial information stored in both QuickBooks desktop and Fixed Asset Manager. Synced data reveals the current financial position of the company. Generally, you will get both the manual and automatic sync option. Once the information is synced, you will be able to track all the depreciation expenses spent on fixed assets and other financial information.

How to Use QuickBooks Fixed Asset Manager

Once you have set up the Fixed Asset Manager feature and synced all the data with QuickBooks desktop, it is essential to manage all the assets that are added to the Fixed Asset Manager account. To use and manage QuickBooks Fixed Asset Manager, follow these steps for tracking and recording your fixed assets.

Assigning Account to Multiple Assets

When you import assets into Fixed Asset Manager or convert asset data, it is possible that some general ledger accounts are eliminated. Hence, you must manually assign a general ledger account to assets.

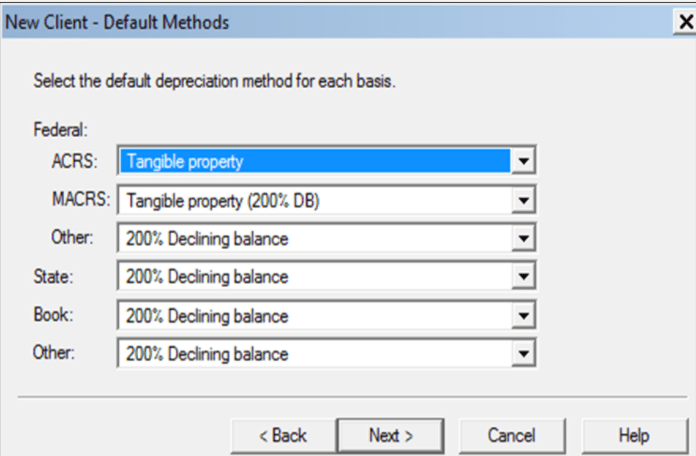

Changing or Adding Depreciation Methods

Under Fixed Asset Manager, there are different types of depreciation methods such as straight-line method, declining balance method, and many more. You can change the depreciation method as per your need for correct financial information.

Also check how to fix QuickBooks printing problems in safari.

Depreciating an Old Asset

Fixed assets are building blocks of the company. It is possible that the company might have fixed assets before using the Fixed Asset Manager. If there are such fixed assets, depreciation must be charged to know the real value of the asset.

Exporting QuickBooks Fixed Asset Items into ProSeries Form 4562

While exporting data from QuickBooks Fixed Asset Manager, it must be in the same year of ProSeries. The reason behind this step is that Fixed Asset Manager and ProSeries are based on tax year, whereas QuickBooks desktop is based on the calendar year.

Importing Fixed Assets from Excel into Fixed Asset Manager

Fixed Asset Manager allows you to transfer important data files from third-party applications. However, you must note that the data files that will be imported must be in Command Separate Value (.CSV) file. You can easily import CSV files in Fixed Asset Manager.

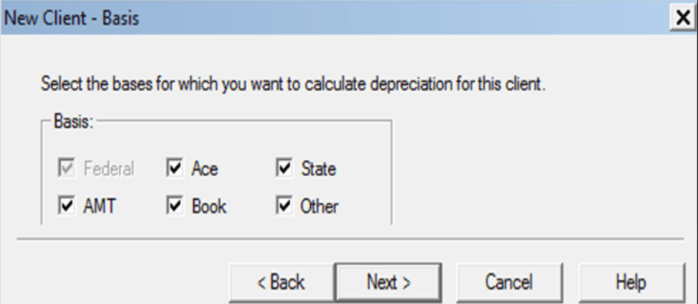

Selecting the Basis on Posting the Journal Entries

Fixed Asset Manager also allows you to change the basis of posting the journal entries in the books of accounts. There are different types of journal entries posting, such as Federal, Book, AMT, ACE, State, and others. You can select your desired posting basis from post journal entries to QuickBooks under the QuickBooks menu.