How to Create & File 1099 in QuickBooks Desktop

Table of Contents

As a vendor or company owner, you become eligible for a variety of taxes and liabilities. And though there are numerous things and taxes to talk about, we are going to talk about 1099, which is an essential thing to consider for a company owner, especially if you have workers who are not your employees. QuickBooks 1099 tax is specially meant for vendors and freelance workers. So, if you are involved in any such business where you need to fill the 1099-MISC tax, you should be well aware of the tax, its preparation, and filing.

So, let’s get started to dig deeper to file the tax through QuickBooks.

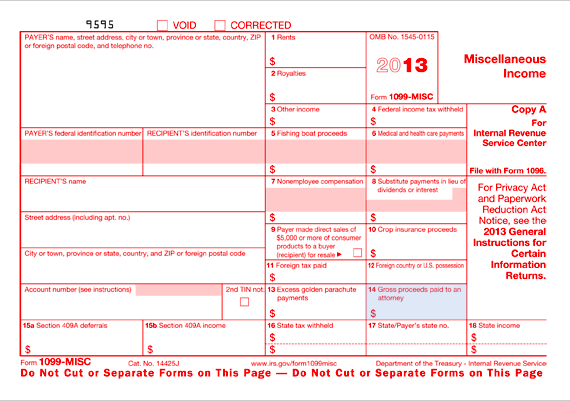

What is 1099?

1099-MIsc is an information form that is used by the firms that report the payment to the non-employees. That means, if you have side-firms and deal with vendors, this form will be an essential thing for you to consider.

You can manually fill them by contacting the professionals. However, if you are a QuickBooks user, you can easily prepare and file 1099 without expert help.

Here in the article, we will be talking about how you can prepare form 1099 in detail and file the form with the help of QuickBooks Desktop.

So, if you are not too keen to contact the professionals and pay them the extra fee, we will suggest you invest your time in the article so that you can know about preparing 1099 along with filing the form.

How to get 1099 forms?

If you are planning to file 1099 from an external source, you may have to look for a better source for getting the legit form and filing firm. However, if you are a QuickBooks Desktop user, you should not worry about this.

Before QuickBooks 1099 filing, there are a few prerequisites that you need to fulfill.

- You should have completely installed the QuickBooks Desktop as per the requirements and preferences

- You should have a Tax1099 account

- You should have a Tax1099 transfer plugin installed

You can download the 1099-add on if you are using QuickBooks and file the form easily by using the 1099 utility.

So, make sure that you fulfill these prerequisites, and you will be able to file the form without any major difficulty using the QuickBooks Desktop and that too without any expert tax expert’s help.

How to file 1099 in QuickBooks Desktop

Once you have fulfilled the prerequisites, you are now ready to file the information. IF you haven’t done this before and want some help in filing and preparing the information, here’s the step-to-step guide on how to file 1099 with QuickBooks.

Step 1: Enable 1099 filing in QuickBooks

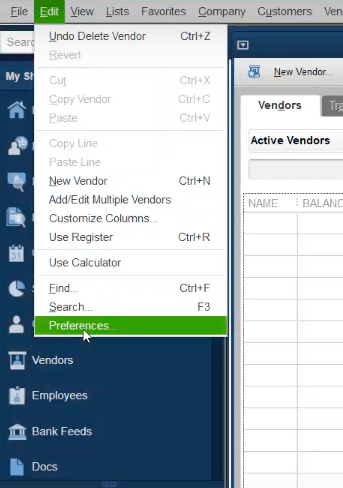

- Go to Edit Menu and navigate to Preferences

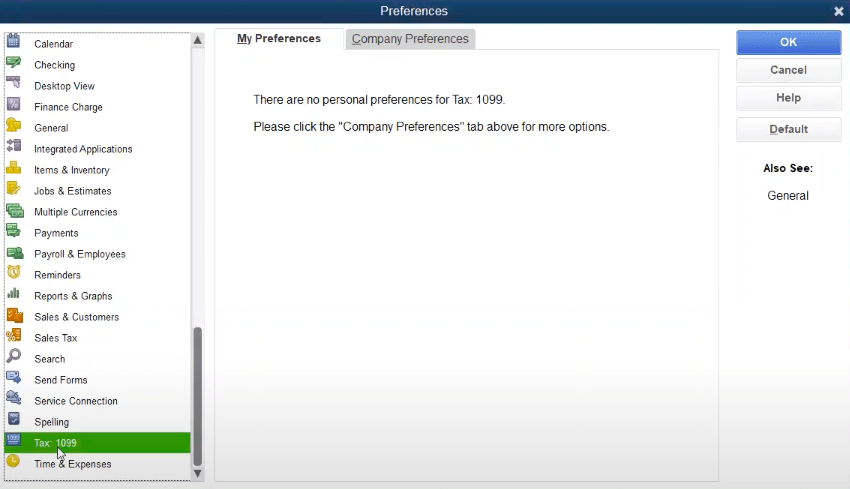

- Here, you can see Tax1099 on the left side

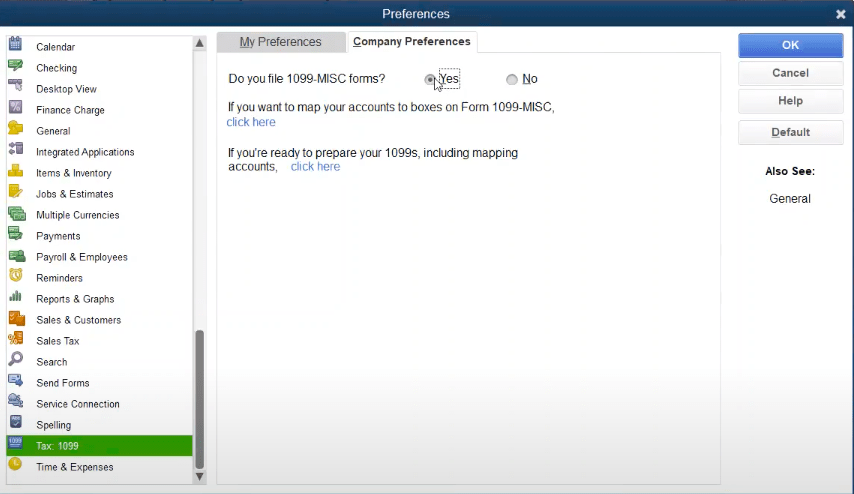

- Click on the Company Preferences tab

- You will be prompted: Do you File 1099-Misc forms?. Click on Yes

- You can now save your preferences.

Step 2: Add a new Vendor

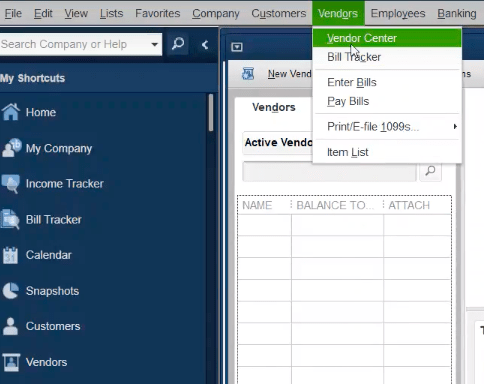

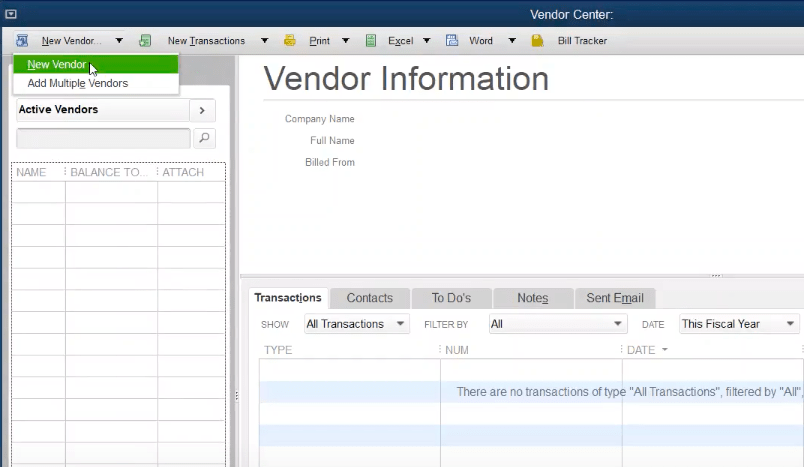

- Select VENDORS, click on Vendor Center and then add a new vendor from the dropdown menu

- Fill the essential form as per the requirements and your records

- Click on OK to save the information

Step 3: Allow the vendors to file 1099

- Click on Vendor Center

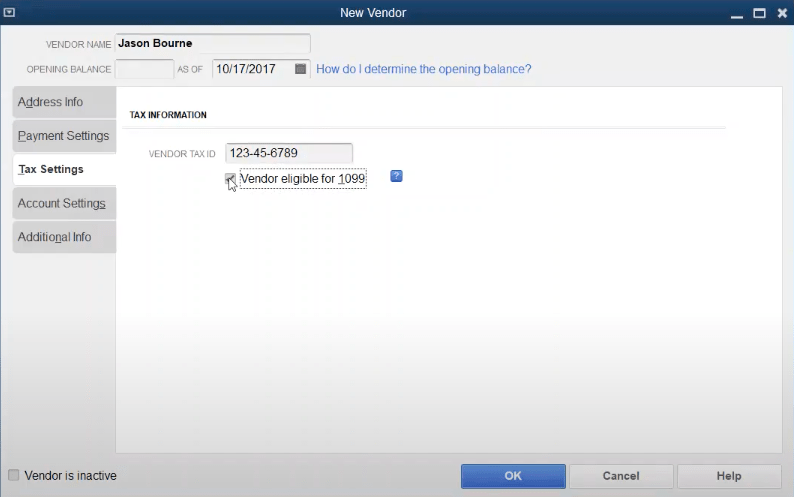

- Right-click on the vendor’s name whom you want to edit. Clicking on Edit vendor

- Navigate to Address Data, and validate knowledge

- Click on Tax settings and then check the Seller Eligible for 1099

- Now enter the Tax ID range in Vendor’s Tax ID Field. Click on OK to save the details

- You can use the same steps for every single vendor whom you want to add for the tax filing

Step 4: Changing the preferences

- Click on Edit and then on Preferences

- Click on Tax 1099

- Click on the Company Preferences tab and press ok when prompted

- A message Click here if you wish to map your account to boxes on kind 1099-MISC

- On clicking, you will get a QuickBooks wizard that will open

- Under the 1099 vendors list, select the proper box for applying payments and other transactions

- You can choose or omit Form 1099 from here.

- Choose the save and exit

How to e-file the 1099 tax form?

Once you have the data prepared with you, you can now work in two ways. You can either provide this data to your financial advisor or file it all by yourself by using the QuickBooks utility.

We will be talking about filing the tax through QuickBooks. So, let’s get started.

Now once you have checked all the information and prepared yourself to file the information, let’s have a look at the procedure for the QuickBooks E file.

- Install the QuickBooks plugin

- Once you have downloaded and installed the plugin, you can use QuickBooks for filing the form through the tax1099.com

- Select the tax1099.com as the e-file vendor from the vendor’s menu

- Click on Upload the data you have prepared in the previous section

- You need to enter your tax1099 account by using the login information you used at the time of creating the account.

- Choose the year you want to file the tax.

- Export the data. You can see the export status by the dialog box that will appear until the export gets completed. In case the dialog box doesn’t close by itself, you can close the box usually once the export reaches 100%

- Now you can see the detailed information in your dashboard. You can review, edit, and delete some entries if needed.

- Once you are done reviewing the copy, you can choose the method of distributing the tax copy to the vendors.

- Lastly, click on Calculate the fee to see the tax amount that you need to pay for the year.

- Click on “Pay and Submit to e-file”.

Contact QuickBooks 1099 Form Experts to help you create, prepare & file 1099

In all, if you are a QuickBooks user and were searching for an easy and reliable way to prepare the 1099 form and file it accordingly, you should once try your hands on the QuickBooks 1099 utility.

There are many other hidden benefits along with saving time and money that would have been wasted in contacting a professional, and you can easily know about them, once you go through the procedure. Contact QuickBooks 24/7 Support for help with the 1099 tax form at +1800-994-0980.