QuickBooks is amazing accounting software that helps entrepreneurs and other businesses to manage their accounts. QuickBooks for Dentists is the best option, If you are willing to start dental practice shortly or practicing at present, you would be surprised to know that QuickBooks is one of the best software for dentists as well. The user is required to set up QuickBooks chart of accounts for dentist business.

Though there are countless dental-specific software such as Dentrix, Ace, and Dovetail, using QuickBooks simultaneously can help you organize your practice. Let’s know about QuickBooks for dentists in detail.

QuickBooks For Dentists: What are the Benefits?

Table of Contents

QuickBooks is a perfect software for dentists with many features. Some of the benefits setting up QuickBooks for Dentist are mentioned below:-

- It allows you to enter your deposits to keep track of them.

- It allows you to write checks and pay bills effortlessly.

- You can easily create a payroll by using QuickBooks.

- With this software, you can reconcile your bank account and credit card account easily.

- Tax counting and paying are easy with QuickBooks.

- It allows you to do all invoices-related work without any hazards.

What QuickBooks Gives You That Dental Practice Management Software Doesn’t?

Though there is much dental practice management software out there, QuickBooks offers dentists some unique features that you wouldn’t find in other dental management accounting software.

Reports

With QuickBooks, you can have customizable reports so that you can understand the profit and loss and also know about the costs of staff and other requirements of your practice. You can also compare the reports with the previous years. So, with these customizable reports, you can get a complete idea of how your practices are running so that you can make strategies accordingly.

Accountant’s copy

You can easily make a QuickBooks accountant copy so that your accountant can easily take care of your finances, make entries for tax purposes, and do other needful work. When your accountant can take care of all these things, your work will be less interrupted.

Bank Feeds

As a dentist, you definitely don’t have the time for bank reconciliations. So, you can connect QuickBooks to your bank and credit card accounts for up-to-date account balances and seamless bank reconciliation.

Budgeting

It is essential to understand how your practice is going and how you can achieve your goal. A detailed budget can help you to achieve your goal and the best part is that it does not require you to spend a lot of time creating it. With QuickBooks, you can create the budget you need without wasting your precious time.

User-Friendly

Most dental management software comes with a complex design, but QuickBooks is a very user-friendly software that comes with a convenient cloud-based package. That allows you to access your financial information from any computer.

Also, Read How to Reconcile Bank Account statement in QuickBooks

How to Customize the QuickBooks Chart of Accounts for Dentists?

QuickBooks, by default, comes with 30 expense accounts. Though most of these accounts are useful, understanding the profit and loss statement with 30 expense accounts can be a little difficult, especially for dental management. To customize the QuickBooks chart of accounts for dentists, one can customize the chart of accounts using sub-accounts so that it can generate more readable and comparable profit and loss statements.

It will also include the details of requirements in an expanded profit and loss statement to examine the practice well.

While discussing the QuickBooks chart of accounts for dentists, the recommended expense accounts are lab fees, dental supplies, payroll (not including dentist pay), marketing /advertising, rent, and general expenses.

Besides that, you can include other accounts such as dentist compensation, interest expense, depreciation expense, and owner perks. Let’s know how you can customize QuickBooks charts of accounts for dentists.

Follow the steps mentioned below for doing that

- First, go to lists and from there head towards charts of accounts.

- Delete the accounts you would not need.

- You can also merge similar accounts and for this, you have to

- Copy the account name you want to keep

- Go to the account where you want to merge it and choose the edit account option.

- Paste the account’s name to this account and leave the rest on QuickBooks as it will recognize the same-named accounts.

(Note– You can hover over the diamond to the list of the account name and click to drag the account to the preferable location)

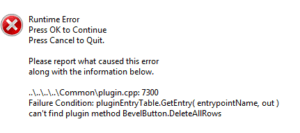

Also Read, How to fix QuickBooks Abort Error in 2023

What are the Advantages of QuickBooks for dentists?

Keeping track of several financial activities can be time-consuming if done manually. With QuickBooks, all of those financial tracking processes would be easy and a method of a few minutes to concentrate on your practice well and climb the ladder of success. The key advantages of using QuickBooks for dentists are-

- QuickBooks is cloud-based software, which means that you can access it from every computer.

- QuickBooks will automatically calculate your GST obligations. You will need this feature if you run a dental clinic of your own.

- It can Sync with payroll, time-tracking, and patient databases. If you want to do all of these processes manually, it will be a headache.

- Missed invoices will prevent you from receiving vital cash inflows. If you don’t pay them on time, you can be in a serious problem. With QuickBooks, tracking invoices is easy. It helps you to generate invoices, keep track of them and send out automated reminders so that you never miss a due date.

- Taxes can be a real headache, and you have to take care of them. QuickBooks can automate business activity statements or installment activity statements for you.

- QuickBooks automatically calculate GST owed and collected as well. You don’t have to worry about the special rules as it applies to all of those.

- As a dentist, you will also need to manage your expenses in QuickBooks, such as staff expenses and other expenses for equipment. QuickBooks helps you to track those expenses.

- As a dentist, you can track all billing, invoices, and other clients’ payment information by using QuickBooks.

Connect with QuickBooks Expert

As there are many things apart from medical practice that you have to take care of, You would definitely need a helping hand. It can be time-consuming with other software, but not with QuickBooks Desktop 2023, as it will do the work for you seamlessly so that you don’t have to take any headaches about financial matters and work to achieve your goal. Get in touch with our QuickBooks support expert for assistance with QuickBooks for Dentists business.

FAQs

Frequently asked questions about setting up QuickBooks for dentists.

Why use QuickBooks for dentists?

It is a one-stop solution for dentists as it helps to maintain all financial transactions. Whether it is tax, invoices, bank account management, or anything else, QuickBooks will help you to track all the financial movements with a single software.

What should accounts receivable in a dental clinic?

If you have a collection ratio of 98%, with a range of 95% to 99%, it is considered good. If your dental practice carries large accounts receivable balances, it causes the likelihood of collection to decrease.

How to calculate the goodwill of a dental practice?

For valuing an average dental practice, at present, the thumb rule is around 50% of the gross fee. For instance, if your gross fees of practice are $100,000, then the practice value would be $50,000.