First of all, Payroll means the complete amount of fee provided by the owner to his employees, make sure every employee meets standard taxes that apply on his reoccurring wage or salary according to the federal law including the facilities provided by the organization such as medical reliefs, transport facilities, etc

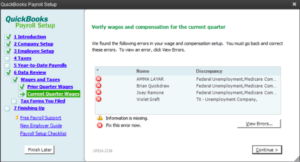

If you are able to manage the payroll on your own then it will save the company’s resources as well as time, you can easily opt for accounting software such as QuickBooks for managing it in an easier way if you are not good with accounts or you have any problem understanding the functions of QuickBooks call the QuickBooks Payroll support number team which will guide you how to make it work.

In the end, if you are not using kind any accounting software make sure you keep and track the records with your employees.

For starting with a payroll in QuickBooks get self-help from the QuickBooks payroll support website.