How to set up a company file

Table of Contents

Open QuickBooks > Go ‘File’> select ‘New Company’ > select ‘Skip Interview’ > enter company name

> create a company file and save to main document folder

Unveiling the Secrets to Seamless Company File Configuration

Setting up a QuickBooks company file is a crucial step towards organizational success. Whether you’re a seasoned entrepreneur or a budding business owner, the process can be simplified and optimized for efficiency. Let’s dive into the essentials of company file setup, unlocking the potential for smoother operations and financial clarity.

The Foundation: Understanding the Basics

Before delving into the setup intricacies, it’s imperative to grasp the fundamental concepts. A well-structured company file forms the backbone of your business, streamlining financial transactions and facilitating strategic decision-making. Here’s a step-by-step guide to guide you through the process:

1. Choosing the Right Software

Selecting the appropriate accounting software is paramount. Opt for platforms like QuickBooks, Xero, or FreshBooks, depending on your business needs. Ensure compatibility with your industry and scalability for future growth.

2. Installation and Initial Setup

Once you’ve chosen your accounting software, initiate the installation process. Follow the prompts, customizing settings as per your business requirements. Establish your company’s profile, including business name, industry type, and contact details.

The Crux: Configuring Your Company File

Now that the groundwork is laid, it’s time to dive into the heart of the matter – configuring your company file for optimal performance.

3. Chart of Accounts Customization

Tailor your chart of accounts to align with your business structure. Define specific categories for income, expenses, and assets. This meticulous customization ensures accurate financial tracking and reporting.

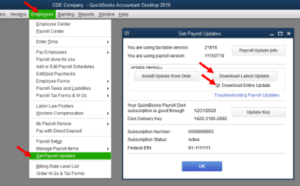

4. Setting Up Tax Information

Navigate to the tax settings section and input relevant details. Accurate tax configuration prevents discrepancies in financial reporting and ensures compliance with regulatory standards.

5. Adding Users and Permissions

Delegate access responsibly by adding users and assigning permissions. This step enhances security and confidentiality within the system, preventing unauthorized access to sensitive financial data.

The Flourish: Advanced Configurations

As you advance in the setup process, explore additional features to elevate your company file’s functionality.

6. Bank Account Integration

Link your business bank accounts to the software for seamless transaction reconciliation. This integration minimizes manual data entry, reducing the risk of errors and saving valuable time.

7. Automation for Efficiency

Explore automation options within your chosen software. Set up recurring transactions, invoicing, and expense tracking to streamline routine tasks. Automation enhances efficiency and allows you to focus on strategic aspects of your business.

The Final Touch: Review and Refinement

Before finalizing your company file setup, conduct a thorough review to ensure accuracy and completeness.

8. Data Validation

Cross-verify all entered data to eliminate discrepancies. Address any inconsistencies promptly to prevent future complications in financial reporting.

9. Backup Procedures

Implement robust backup procedures to safeguard your company file from potential data loss. Regular backups offer a safety net, allowing you to restore critical information in case of unforeseen circumstances.

Conclusion

In conclusion, mastering the art of company file setup is pivotal for a thriving business. By following these steps and leveraging the capabilities of your chosen accounting software, you pave the way for streamlined operations, accurate financial reporting, and sustainable growth. Empower your business with a solid foundation – start your company file setup journey today!

For any other company file related queries call our QuickBooks experts.