Expenses in QuickBooks

Table of Contents

In this article, we will talk about recording expenses & what type of expense is QuickBooks. Every transaction that you do with your debit card, credit card, bank payments, or online transfer is referred to as expenses in QuickBooks. For example, the Cost of Goods Sold (COGS) is an expense made by Sales in a company.

What Type of Expense is QuickBooks

When adding an expense in QuickBooks for a QuickBooks purchase. The expense that the user will add for the money spent on purchasing QuickBooks will depend upon the subscription plan. It depends upon which version of QuickBooks user has & the subscription plan. If it’s reoccurring or annual. The category for the expense is predefined by IRS Schedule C to ensure your estimated taxes are reported accurately.

How To Create Expense in QuickBooks Desktop

QuickBooks will automatically add default expense categories in your Chart of Accounts on the QuickBooks desktop.

To create your own custom expenses on the QuickBooks desktop follow these steps:-

- Navigate to the Accounting option on the left

- Click on Chart of Accounts

- Select the New tab on the top.

- Choose a Category /Account type

- Select Detail type

- Enter the Name and click on Save and Close

How to record expenses in QuickBooks Online

Follow these steps to record expenses in QuickBooks:-

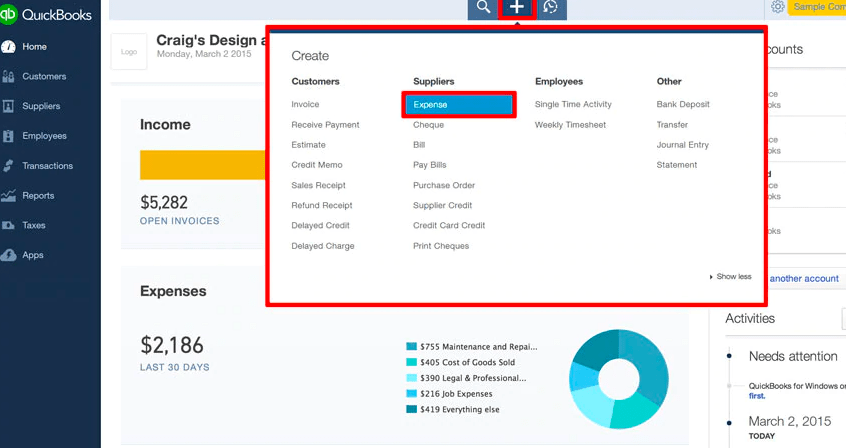

- Click on the gear icon (+)

- Under the Suppliers dropdown

- Click on Expenses

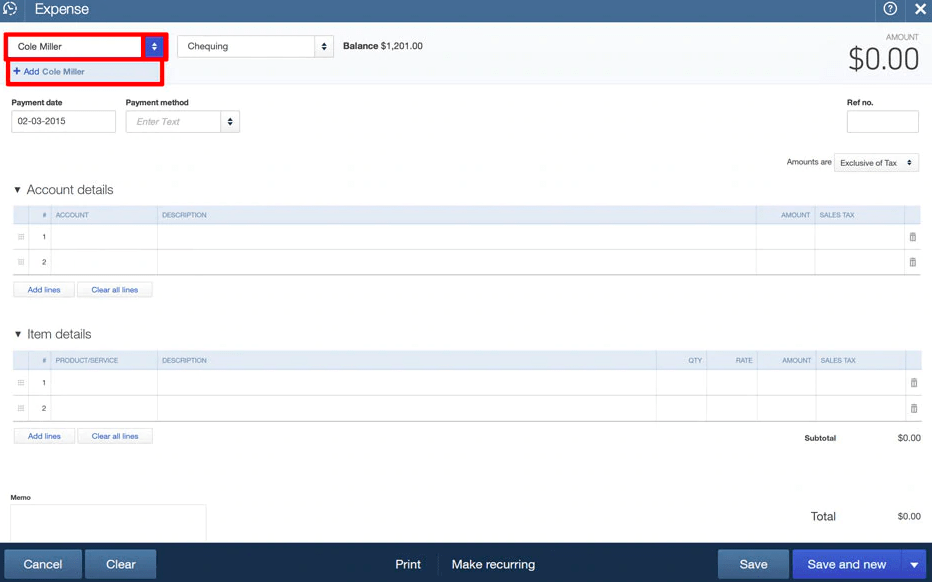

- Now select the Payee you want to record the expense for

- If the payee is not added, add it by typing the name & then clicking on Add

- Choose the account from where you are buying the product. Remember if you are purchasing via debit card you should choose a Chequing account

- Enter Date, payment method, category, description & amount. Then Save it, after adding the appropriate sales tax according to the state.

Contact QuickBooks Experts to help with Expenses in QuickBooks

Get in touch with certified experts to brief you on the correct knowledge required to record the expenses in QuickBooks. Call toll-free 24/7 QuickBooks error support at +1888-727-4587. Get an answer to your queries like what type of expense is QuickBooks.